Sell Oct. WTI crude oil below $46.50/b

Crude oil looking increasingly exposed followed big jump in spec longs

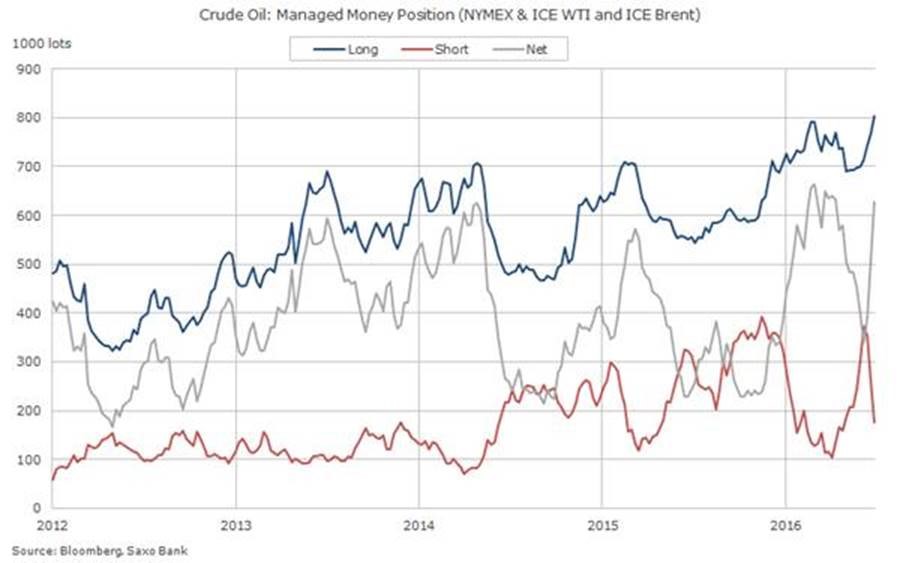

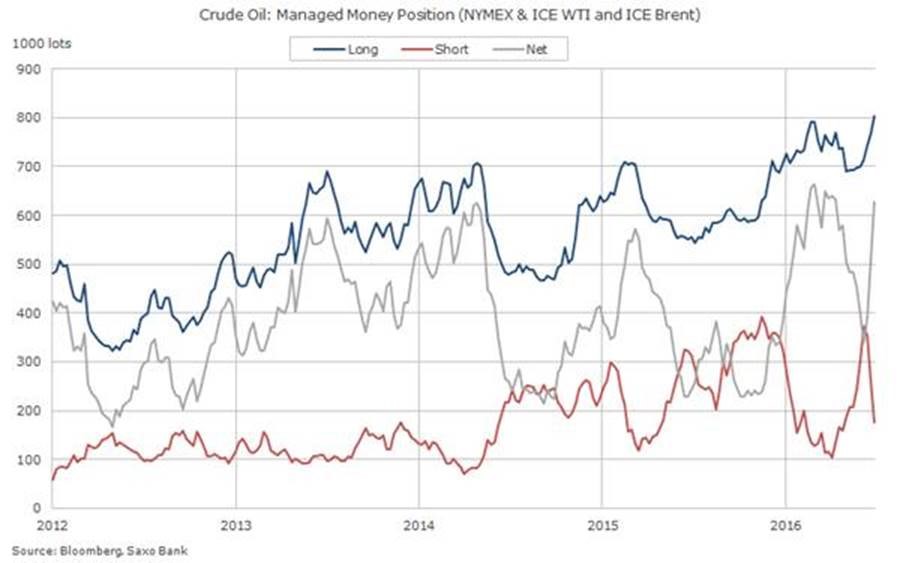

In our weekly “Commitments of Traders” update earlier today we highlighted how oil bears have been exiting the market at the fastest pace on record.

August has been a crazy month in terms of movements in the oil market. At the beginning of the month hedge funds driven by the outlook of rising oil and product inventories had accumulated a record gross-short in WTI crude oil. These positions were hurt badly by the resumption of verbal intervention not least from the Saudi oil minister.

During a two week period up until August 23 funds bought a record 142,000 lots with 85% of the buying being short-covering. During the latest of these two weeks some 84,000 lots were bought, all of it above $46.50/b.

Adding Brent crude oil to the equation we find that the net-long during the past few weeks has surged to 627,000 lots.

While the supporting re-balancing of the global oil market continue we find that most of the rally seen these past three weeks has been driven mostly by short-covering. With fundamentals yet to provide oil with a strong enough tailwind to break higher we see the short-term risks once again being skewed to the downside. The combination of renewed dollar strength and doubts about Opec’s ability to show a united front could add to the negative sentiment over the coming weeks.

Short term:

Long term view:

Trade parameters:

- Sell CLV6 or OILUSOCT16 on a stop at $46.40

- Stop: $47.80 (1 ATR)

- Target: $44.70 and $43.60

Time horizon: 1 to 2 weeks

Trade management: On hitting the first target lower the stop on remaining order to entry

Key risks: Continued verbal intervention from Opec members, US inventory report on Wednesdays and US job report on September 3.

Seasonality: From a seasonal perspective crude oil has fallen every September the last five years as inventories rose in response to lower refinery activity.

Yours sincerely,

Ole S Hansen | Head of Commodity Strategy