Weekly Market Outlook 5th September 2016

UPCOMING KEY MARKET EVENTS

| Date/Time | CY | Event | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 05 Sept/0230 | JPY | BOJ Governor Kuroda Speaks | n/a | n/a | n/a |

| 05 Sept/0830 | GBP | Services PMI | 47.4 | n/a | 49.1 |

| 07 Sept/0130 | AUD | GDP q/q | 1.1% | n/a | 0.4% |

| 08 Sept/1230 | EUR | ECB Press Conference | 48.2 | n/a | 49.1 |

SPEECHES

- 10:30 – JPY – Kuroda Speaks at a Kyodo News event

OVERNIGHT NEWS

- US:

- Non-Farm Payrolls roe lower than expected at 151k (Exp. 180k) but was upwardly revised the previous month to 275k from 255k. The rise came from restaurants hires: 34k, professional and business services jobs rose 22k; social-assistance jobs increased 21,7k. On the opposite side, the manufacturing sector lost 14k jobs and construction 6k jobs.

- Average hourly earnings for private-sector workers rose 0.1% MoM (Exp: +0.2%) and 2.4% YoY (Exp. 2.5%) from July’s 2.7% annualised gain. The unemployment rate was unchanged at 4.9% (Exp. 4.8%).

- Factory Orders rose 1.9% (Exp. 2.0%) from -1.8% in June. It was driven by Durable Goods orders.

- New York ISM dropped to 47.5 from 60.7

- FED SPEECH:

- Jeffrey Lacker said "It appears that the funds rate should be significantly higher than it is now," and . "The way the data is playing out I think the longer we wait there is a material increase in risks that we run,". Lacker is a non-voter member of the FOMC.

- GERMANY:

- The Social Democrat won a state election against Merkel’s CDU party 3rd behind an anti-immigration party Alternative for Germany Party. It also signals a big risk for Merkel in next year Federal elections if he chooses to run.

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 95.87 | 0.24% | 95.189 – 95.958 |

| EURUSD | 1.1158 | -0.37% | 1.1145 – 1.1252 |

| USDJPY | 103.96 | 0.78% | 102.8 - 104.32 |

| AUDUSD | 0.7565 | 0.28% | 0.7536 – 0.7616 |

| GBPUSD | 1.3295 | 0.14% | 1.3253 - 1.3352 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1322.93 | 0.74% | 1304.83 - 1330.2 |

| Silver | 19.37 | 2.33% | 18.7575 - 19.463 |

| Oil (BRENT) | 46.59 | 1.50% | 45.41 - 47.02 |

| Oil (WTI) | 44.16 | 1.31% | 43.16 - 44.67 |

COMMODITIES

Precious Metals: Gold and silver futures gained after disappointing non-farm payroll data boosted the previous' appeal as a safe heaven. Gold Dec has inched lower for the past two weeks and touched 100d MA at 1305.50 and was supported. It is expected to rise even more and we might see 50d MA at around 1342 to be touched in recent days.

Oil: Near month WTI crude bounced 3% after a four-day losing streak, as Saudi Prince Turki Al-Faisal and Russia president Putin are both in favour of a production freeze as long as all other oil-producing nations follow suit. Now it is hovering around 200d MA level at 44.31, a clear break of which will resume the down trend.

FOREX NEWS

- Mixed reaction in the USD following the NFP which rose against some currencies like EUR (ECB meeting coming this week and market expects them to lengthen the QE and the loss in a local elections from Merkel’s party) and JPY with the market hoping the BOJ will act in their next monetary policy meeting on the 21st of September. However, USDCAD dropped

- USDCAD dropped after Deputy Crown Prince Mohammed bin Salman said after meeting with Vladimir Putin in Hangzhou that stability is impossible if both countries don't cooperate creating a surge in Oil prices. USDCAD dropped 0.8% on that. The pair has been trading in a range since May but the 200d MA should be a strong resistance at 1.3283.

- In Emerging Markets, the market was overall quiet but more inclined to sell USD against EM. USDKRW dropped 0.5% in NY, USDCNH is still able to hold below 6.7000 level in Spot.

USDJPY

Over the past two weeks, USDJPY has risen sharply from its August base around the key 100.00 psychological level. This rally has been driven by both a continued strengthening of the US dollar on the previously increased expectations of a near-term Fed rate hike, along with an extended pullback for the Japanese yen. In the process of this rise, USDJPY broke above its 50-day moving average and the key 103.00 resistance level. Despite Friday's disappointing Non Farm Payroll Report, USDJPY continued to climb further, targeting the next major resistance around the 105.50. Because of renewed doubts over a September Fed rate hike due to the jobs miss, however, USDJPY's rise could well be capped, at least until the next FOMC meeting to be held on 21st September. In case of a pull back below the 105.85 level and a subsequent break below noted 103.00 level, the 100.00 psychological support level will hold.

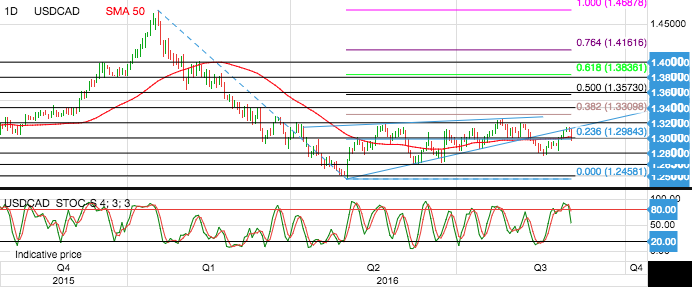

USDCAD

For the past The combination of a stronger US dollar and falling oil prices in the past two weeks boosted USDCAD to a new three-week high of1.3145 last week from its 1.2800-area support base in mid-August. In the process of this rise, the currency pair climbed back above the key 1.3000 psychological level and touched the bottom border of a large wedge chart pattern below which price broke down in early August. On Friday, a rebound in crude oil prices prompted a pull back for USDCAD from this chart pattern resistance. With a disappointing NFP report on Friday, pressure on the US dollar in the run-up to the September FOMC meeting less than three weeks from now could place additional weight on USDCAD. Already, oil prices have started boosting due to a weaker US dollar, and this could in turn lend more strength to the Canadian dollar, pressuring USDCAD even further. With any sustained re-break below the noted 1.3000 psychological level, a further USDCAD retreat has its next major downside target at the noted 1.2800 support level.

Draghi Nears His QE3 as ECB Seen Relying on Ever-More Stimulus

If at first you don’t succeed, extend, and then extend again.

With euro-area inflation stuck near zero for almost two years and Brexit now threatening to undercut the region’s recovery, economists see European Central Bank President Mario Draghi as highly likely to lengthen quantitative easing for a second time. That would take the asset-buying program beyond its current end-date of March 2017 and above the target of 1.7 trillion euros ($1.9 trillion).

More than 80 percent of economists in a Bloomberg survey expect such a decision, with a similar share predicting the ECB will tweak its purchasing rules to avoid running out of securities to buy. Almost half of respondents foresee action on Thursday, when the Governing Council sets policy in Frankfurt, with almost all the rest predicting an announcement at the October or December meetings.

Draghi’s position is reminiscent of the one Ben Bernanke faced in 2012 when the then-chair of the U.S. Federal Reserve added his third installment of asset purchases, so-called QE3, and promised to keep going as long as necessary. The ECB head has repeatedly said officials will keep up their stimulus until they see a sustained adjustment in the path of inflation, and the signs are that’ll take more than another six months.

“Conditions to withdraw monetary stimulus will likely not be met next March,” said Kristian Toedtmann, an economist at DekaBank in Frankfurt. “There is no point in postponing this decision.”

Inflation in the 19-nation euro area was 0.2 percent in August, unchanged from July, and core inflation weakened. Fresh ECB projections are scheduled to be released on Sept. 8., an event that has often underpinned a decision to change policy.

Read More at bloomberg.com