Daily Market Update 12th October 2016

ECONOMIC DATA OF THE DAY

| Time | CY | Indicator | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 07:50 | JN | Machine Orders MoM | -4.70% | -2.20% | 4.90 |

| 07:50 | JN | Machine Orders YoY | 7.90% | 11.60% | 5.20% |

| 14:45 | FR | CPI YoY | 0.40% | -- | 0.40% |

| 19:00 | US | MBA Mortgage Applications | -- | -- | 2.90% |

SPEECHES

- 09:30 – JPY – BOJ board member Harada gives speech

- 17:00 – GBP – BOE deputy governor Cunliffe speaks in parliament in London

- 20:00 – USD – Fed’s Dudley speaks at Fireside Chat in Albany

- 21:40 – USD - Fed’s George speaks at Chicago Fed’s payments conference

OVERNIGHT NEWS

ENGLAND:- Prime Minister Theresa May has accepted that Parliament should be allowed to vote on her plan for taking Britain out of the European Union, but asked lawmakers to do it in a way that gives her space to negotiate.

- Parliament will debate on Wednesday a motion from the opposition Labour Party calling for a “full and transparent debate on the government’s plan for leaving the EU” and for Parliament to be able to “properly scrutinize that plan” before she begins formal talks. The request is supported by some lawmakers from May’s own Conservative Party. In response, May late on Tuesday tabled an amendment that effectively accepted the motion, adding that there shouldn’t be an attempt to block Brexit or “undermine the negotiating position of the government.” (Bloomberg)

- South African Finance Minister Pravin Gordhan was summoned to appear in court on fraud charges on November 2nd. The announcement may disrupt preparations for Gordhan’s mid-term budget scheduled for Oct. 26, when he’s expected to commit to impose tighter reins on spending.

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 97.69 | 0.79 | 96.90 - 97.76 |

| EURUSD | 1.1063 | -0.76 | 1.1049 - 1.1142 |

| USDJPY | 103.33 | -0.10 | 103.18 - 104.07 |

| AUDUSD | 0.7562 | -0.89 | 0.7534 - 0.7616 |

| GBPUSD | 1.2287 | -1.93 | 1.2090 - 1.2376 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1252.80 | -0.54 | 1252.70 - 1262.29 |

| Silver | 17.46 | -1.01 | 17.41 - 17.83 |

| Oil (BRENT) | 52.41 | -1.37 | 52.12 - 53.32 |

| Oil (WTI) | 50.79 | -1.09 | 50.39 - 51.54 |

COMMODITIES

Precious Metals: Gold prices edged lower again yesterday after breaking key technical support of $1,300 last week on bets for rising US rates, with next level at $1,250 in focus. Gold ETP holdings at 2,046.4 t on Monday, highest since 2013

Oil: Both WTI and Brent retreated on doubts of OPEC oil output agreement , while IEA commented that oil supply and demand could rebalance earlier than expected if OPEC deal is implemented. On WTI charts, inverse head and shoulders forming since July 2015, may prompt resistance around $51.70 to be broken soon.

FOREX NEWS

- U.S. stocks posted their biggest percentage drop since early September as third-quarter earnings season started and aluminium giant Alcoa Inc.’s results cast a shadow over the market. A stronger dollar also hurt sentiment. The S&P 500 index slid 1.2% to 2,136.73, with all of its main sectors declining.

- Alcoa shares slashed 11% after the company reported results that missed expectations.

- Illumina Inc. shares slumped by 25% and recorded the worst daily loss in five years, according to FactSet data, after the biotech company issued a revenue warning late Monday.

- European stocks ended in the red, pulled back by energy sector. However luxury shares were solidly higher on an earnings report from LVMH SE. The Stoxx Europe 600 ended 0.5% lower at 340.17, the fourth loss in five sessions. The FTSE 100 ended 0.4% lower to 7,070.88, however recorded its highest intraday level at 7,129.83, as the pound continued to suffer at three-decade lows.

- France’s LVMH Moët Hennessy Louis Vuitton SE jumped by 4.5%, the most since late July, after it reported strength in its Asia business contributed to a rise in nine-month revenue.

- Major oil companies BP PLC and Royal Dutch Shell PLC headed lower, losing 1.6% and 0.7% respectively, as oil prices fell after the IEA reported that OPEC boosted its output to a record 33.64 million barrels a day in September.

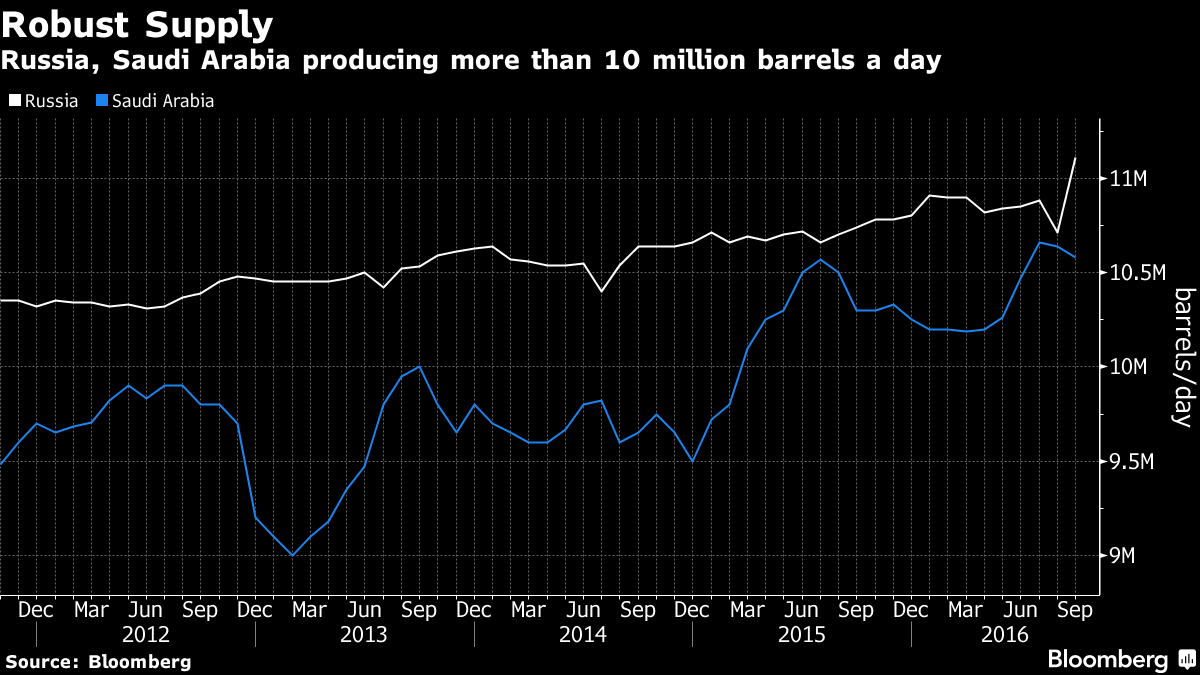

Oil held above $50 a barrel amid uncertainty over Russia’s willingness to join OPEC efforts to stabilize the market.

Futures were little changed in New York after declining 1.1 percent Tuesday. Russia’s largest producer Rosneft PJSC said it won’t reduce output, according to Reuters, after President Vladimir Putin had earlier said his nation would join a supply deal with the Organization of Petroleum Exporting Countries. Supply and demand will come back into balance earlier than expected if OPEC’s accord to trim production is implemented, the International Energy Agency said.

Read the full article at bloomberg.com