Weekly Market Update 12.10.2015

Fixed Deposit Rates (USD)

| Tier | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| 50k-99k | 0.40 | 1.50 | 2.00 | 2.50 |

| 100k-499k | 2.10 | 2.60 | 2.85 | 3.50 |

| 500k-999k | 2.30 | 2.80 | 3.05 | 4.05 |

| 1 Million and above | 2.50 | 3.00 | 3.75 | 4.25 |

(Source: Fab Treasury)

Fixed Deposit Rates (EUR & GBP)

| Currency | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| EUR | 0.12 | 0.16 | 0.21 | 0.31 |

| GBP | 0.70 | 0.81 | 0.90 | 1.21 |

(Source: Fab Treasury)

Market Rates (from 5th - 11th October)

| Currency | Open | Close | High | Low |

|---|---|---|---|---|

| USDJPY | 119.821 | 120.121 | 120.563 | 119.621 |

| GBPUSD | 1.51675 | 1.53089 | 1.53828 | 1.51352 |

| EURUSD | 1.11605 | 1.13557 | 1.13868 | 1.11605 |

| NZDUSD | 0.64054 | 0.66695 | 0.67201 | 0.64054 |

| USDGHS | 3.70613 | 3.75966 | 3.75966 | 3.70613 |

| USDZAR | 13.72850 | 13.33320 | 13.77269 | 13.23642 |

| USDNGN | 199.04534 | 198.94899 | 199.18378 | 198.85766 |

| USDKES | 103.08769 | 103.11789 | 103.18802 | 103.08113 |

(Source: Fab Trader Platform & exchange-rates.org)

Metals and Stocks (from 5th - 11th October)

| Metal | Open | Close | High | Low |

|---|---|---|---|---|

| Silver | 15.2270 | 15.8200 | 16.0960 | 15.0805 |

| Gold | 1,137.53 | 1,155.62 | 1,159.55 | 1,130.06 |

| Stocks | ||||

| US 500 | 1,950.24 | 2,014.33 | 2,021.47 | 1,946.74 |

| Hong Kong 50 | 21,833.0 | 22,396.0 | 22,814.0 | 21,708.0 |

| UK 100 | 6,250.27 | 6,406.50 | 6,452.57 | 6,211.20 |

| Germany 30 | 9,724.94 | 10,096.40 | 10,146.90 | 9,647.42 |

(Source: Fab Trader Platform)

S&P 500 Index Caps Best Week This Year While Energy Rally Ends

U.S. stocks rose, with the Standard & Poor’s 500 Index posting its strongest weekly gain this year, as equities continued to rebound from their worst quarter since 2011. Shares advanced Friday without the help of energy and raw-material companies, the two best-performing groups so far this month, as energy snapped its longest winning streak in six years. Apple Inc. added 2.4 percent to boost technology shares. Alcoa slumped 6.8 percent to weigh on commodity related companies.

The S&P 500 added 0.1 percent to 2,014.89 at 4 p.m. in New York, up 3.3 percent for the week, the most since December. The Dow Jones Industrial Average rose 33.74 points, or 0.2 percent, to 17,084.49. The Nasdaq Composite Index gained 0.4 percent. About 6.8 billion shares traded hands on U.S. exchanges, 8 percent below the three-month average. “Policy makers are trying to be prudent with policy, but not panicking over the global outlook,” said Brian Jacobsen, who helps oversee $250 billion as chief portfolio strategist at Wells Fargo Advantage Funds in Menomonee Falls, Wisconsin. “We’ll see whether or not we can hold above 2,000 in the S&P 500 and build from here ahead of earnings.”

(Source:bloomberg.com)

Kenya set to conclude talks on $750 mln syndicated loan

Kenya is about to conclude talks for a syndicated loan of up to $750 million in the next two weeks in an effort to reduce local borrowing and curb surging interest rates, a senior Finance Ministry official said on Friday.

Yields on Kenyan Treasury bills jumped to more than 20 percent this week after the central bank embarked on a tightening cycle in June following extreme volatility in the exchange rate. "We have been working this time on a syndicated loan, which could be up to $750 million," Kamau Thugge, principal secretary at the Treasury, told reporters.

"We expect that money to come in the next two weeks. Once we have that money we should be able to reduce interest rates back gradually."

The loan is being arranged by Standard Chartered, CFC Stanbic and Citi, Thugge said, adding that the interest rate was still under negotiation and that it would be based on Libor.

"It is reasonable compared to domestic borrowing ... If you are borrowing even at 6 percent, and now that the shilling is strengthening, it is a much better deal," he said.

Finance Minister Henry Rotich set the fiscal deficit at 570.2 billion shillings ($5.54 billion), or 8.7 percent of GDP, for the financial year starting July.

External borrowing for the year was set at 340.5 billion shillings while local borrowing would amount to 229.7 billion shillings. Thugge said they may borrow more externally and reduce local borrowing in order to lower interest rates.

"We want to lower the cost of borrowing and then, once interest rates come down, we can then come back to domestic borrowing," he said.

Kenya first tapped international capital markets last year when it issued its debut Eurobond at favourable rates. It has left its options open in terms of the instruments it will use to borrow abroad again, with even an Islamic Sukuk bond being under consideration. (Editing by Gareth Jones)

(Source:reuters.com)

Nigeria reveals oil price drop damage in data transparency drive

Proceeds from Nigeria's oil receipts fell by two-thirds between September 2014 and July this year, the state oil company in Africa's top crude producer said on Sunday as it unveiled statistics aimed at improving transparency.

Africa's biggest economy, which relies on crude sales for around 70 percent of government revenues, has been hit hard by the fall in global oil prices over the last year.

"The dwindling oil price has negatively affected the NNPC (Nigerian National Petroleum Corporation) dollar contribution to the federation account," the report said.

"The receipts witnessed a sharp decline of more than 67 percent from September 2014, when the receipt was at its peak, to July 2015 with dire consequences to the federation," it said.

The report showed that total receipts for crude oil and gas exports between January and August 2015 were $3.4 billion.

NNPC has begun the monthly publication of provisional financial and operational reports after new chief Emmanuel Kachikwu pledged to introduce the approach as part of a drive to crackdown on corruption in the oil sector.

"Illustrated with tables, graphs and charts, the report vividly throws light into aspects of NNPC's operations that were once described as 'opaque'," said NNPC spokesman Ohi Alegbe.

(Source:reuters.com)

(Source:Fab Trader Platform)

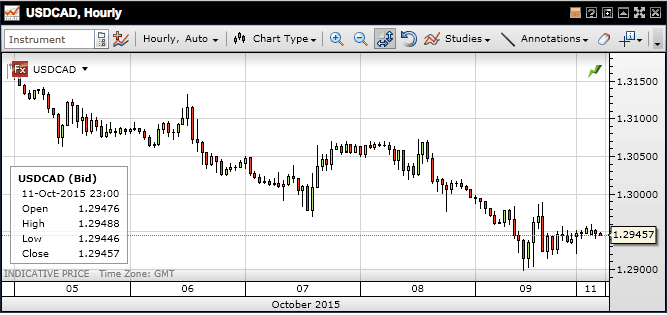

USD/CAD

The Canadian dollar had an excellent run last week, posting gains of more than 200 points. The USD/CAD opened the week at 1.3171 and moved lower throughout the week, touching a low of 1.2899, testing support at 1.2930. This sustained drop has been the result of rebounding crude oil prices combined with better than expected Canadian employment numbers. On the part of the USD, the dovish Fed minutes sent the greenback broadly lower and the loonie took full advantage. USD/CAD closed at 1.2939, its lowest level since July.

(Source: Fab Trader Platform)

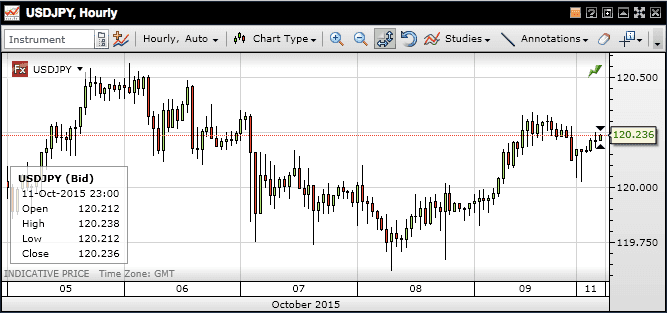

USDJPY

USD/JPY has continued to range-trade in a converging consolidation, otherwise known as a triangle pattern. This pattern has been in place since late August. The NFP report was a huge disappointment,ending the trading week on a sour note. The yen held its own, but wasn’t able to take advantage of the NFP’s poor performance. On any breakdown below the triangle pattern, the currency pair could then target the next major objectives at the 118.00 and then 116.00 support levels. Upside resistance on any sustained trading above 120.00 continues to reside around the upper border of the noted triangle pattern.